How to use your benefits to improve your financial wellbeing

Table of Contents

You’ve probably heard that your employer-provided benefits are part of your total rewards package. If you’re like me, there’s a good chance you think that sounds very cool, and it is—it’s the sum total of all the wonderful things you get from your employer.

But your benefits aren’t just add-ons: they can be major pillars of support in reaching your goals, even when it comes to your bank account.

Whether you’re working to pay down debt like student loans, saving up to buy a new place, or starting to think about retirement in earnest, your employer likely provides a few tools to help you meet your financial wellness goals.

Explore your opportunities for tax-advantaged savings

There are two major categories of tax-advantaged accounts:

Tax-exempt accounts: You don’t have to pay taxes on the money that goes directly into these accounts from your paycheck.

Tax-deferred accounts: The money deposited into these accounts isn’t taxed until you withdraw it (and there are often conditions around when and how to do this to avoid penalties).

Your employer may offer some combination of tax-advantaged savings account options to help you pay for everything from visits to the doctor’s office to the cost of your commute.

These accounts commonly include enough letters to fill a bowl of alphabet soup:

Healthcare Savings Account (HSA)

Flexible Savings Account (FSA)

Limited Flexible Spending Account (LFSA)

Dependent Care Flexible Spending Account (DCFSA)

Commuter Flexible Spending Account (Commuter FSA)

It might seem like a hassle to set these up. It might seem like an extra account to keep track of. But the ability to move thousands of dollars into a tax-exempt account to spend on life’s necessities is a great way to get more out of your paycheck every month (and year).

The one caveat: some of these tax-advantaged accounts are yours to keep forever, some have rollover limits year-to-year, and others are “use it or lose it.” This all depends on the type of account you choose.

If one of your accounts is employer-sponsored, check whether they allow yearly rollover. As you explore your options, keep an eye on how much you actually plan to spend in that category for the year with the account’s restrictions in mind.

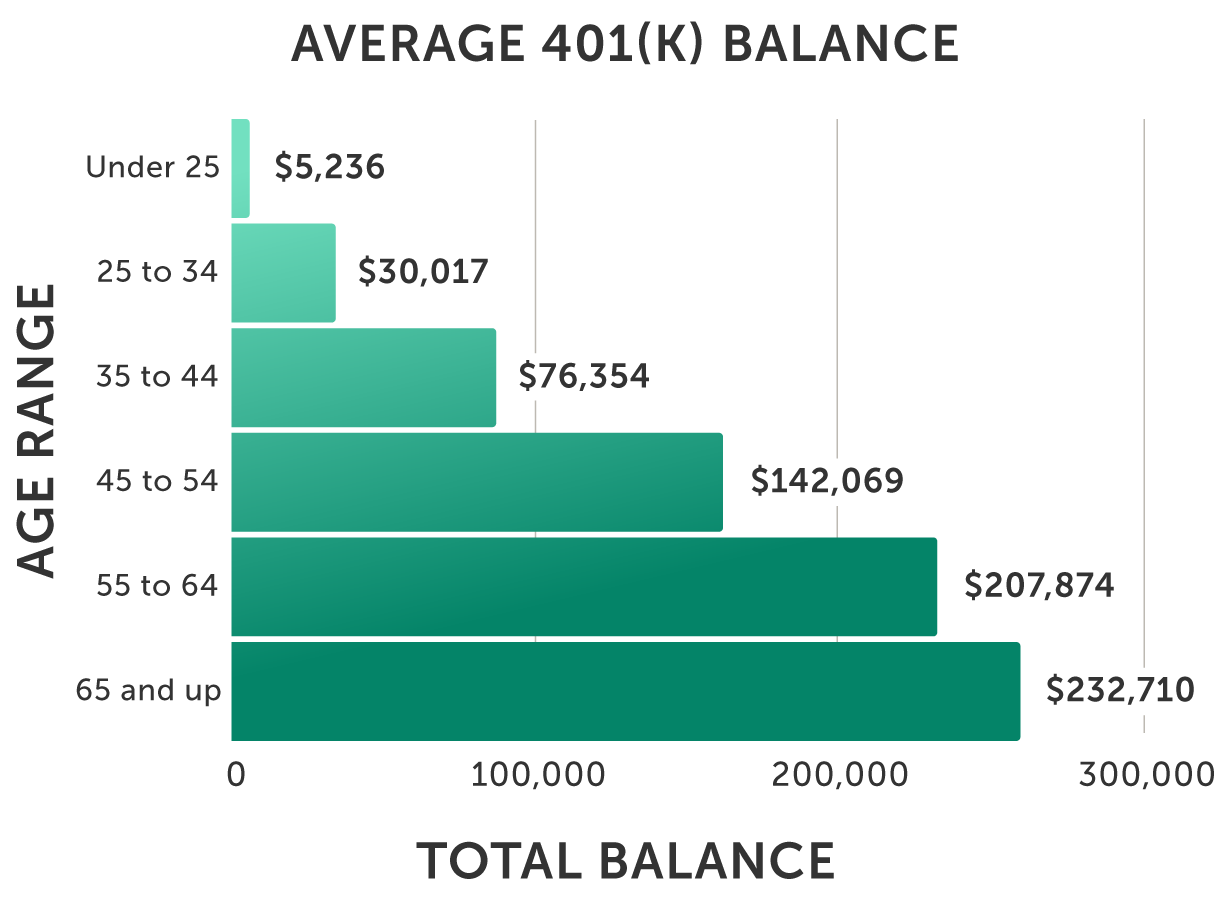

Get tax benefits by saving for retirement

Are you the type who has been saving for retirement since they got their first paycheck, are you pretty sure you’re going to work forever, or are you somewhere in between? (Me, too.)

The conventional wisdom about retirement savings is that if your employer offers a match, it’s a good idea to at least meet them at that number so you aren’t leaving income on the table.

Whether your employer offers you access to a 401(k), 403(b), an IRA, or another type of retirement plan entirely, take the time to consider what they’re offering and how it might fit into your financial plans. You can read more about retirement plans here, then check with your employer to make sure you’re taking full advantage of what’s offered.

Find in-network providers

One of the many cool things about health insurance is that once you have it, certain care providers become a part of your network. Basically, your insurance company has negotiated a deal with in-network providers, and you come out on top and receive care from them at a lower cost than usual.

Typically, your insurance provider will have some sort of online tool that allows you to find in-network providers in your area. If not, you can always call your doctor’s office directly or speak with an insurance representative to double-check. Costs may vary depending on the care you need, the provider you see, and the specific plan that you have.

You can still go to doctors outside of your network, but keep in mind that you’ll likely have to pay much higher fees.

Access an Employee Assistance Program

When you were onboarded for your current role, odds are you heard about an Employee Assistance Program (EAP) that’s available to you.

But ALEX, you wonder, how can you be so sure?

EAPs offer free, confidential support to employees for work and non-work-related issues. This typically includes short-term counseling, referrals, and follow-ups.

They’re often promoted as a quick avenue to mental health support, but EAPs can help with a range of issues, including support for folks going through financial struggles. For example, you can call an EAP when…

You need a referral to a financial advisor to help you plan for retirement.

You’re feeling overwhelmed by trying to manage your budget.

You’re curious about available programs to help you pay off your student loans.

You’re going through a divorce and you’re unsure how your benefits can help support you through this financially complicated transition.

If you’re ever unsure whether an EAP is the right place to go with a question, it’s worth a shot! Remember: free and confidential.

Discover 6 ways to save on medical care

Life can get expensive, but there’s a good chance you have benefits that can help you save. Some of these benefits, HSAs and FSAs, tax-advantaged accounts, and in-network providers, have already been mentioned above.

But fear not: we’ve only just scratched the surface of all the ways your benefits can help you save.

From prescriptions to preventive care, check out six ways your benefits could help you save, and see what you can implement to reach your financial wellness goals this year.

Talk to your colleagues about their favorite financial benefits

You receive a lot of messages about your benefits options throughout the year, and it can be all too easy to overlook a program that could help you save for your future.

So, strike up a conversation with your colleagues, and don’t be afraid to ask what’s working for them as they plan for the future. While everyone’s financial situation is different, the benefits you’re offered all come from the same company.

Your teammates may just have a few tips to share that can help you reach your financial goals this year.