What to know about HSAs and FSAs

Table of Contents

As you’re navigating the sea of your benefits, you might have more decisions to make than you thought. One of those decisions may be choosing an HSA, an FSA, or a combination of both.

The good news? There are a lot of similarities between your options, and they’re great perks to have. The even better news? This page has a deep trough of information to help you understand these accounts and make the benefits decision that works best for you.

Anchors away — let’s set sail into the ocean of acronyms.

What is an HSA?

An HSA, or Health Savings Account, is a type of bank account you can use specifically for qualified medical expenses. HSAs are triple-tax advantaged, meaning deposits you make are tax-deductible, your account’s growth is tax-deferred, and any spending is tax-free, as long as it's on qualified expenses.

Only certain plans are HSA eligible — you’ll need to be enrolled in a High Deductible Health Plan (HDHP) to have an HSA account. In 2024, that means an annual medical plan deductible of $1,600 for self-coverage or $3,200 for family coverage, according to the IRS.

What can I use an HSA for?

Your HSA plan usually comes with a special debit card that you can use to pay for or reimburse yourself for qualified medical expenses, including deductibles and copayments.

Sometimes, you may need your doctor to write a Letter of Eligibility to verify that certain expenses are required to diagnose, treat, or prevent a medical condition. While this letter doesn’t always guarantee eligibility, it can be your best shot at coverage for certain medical expenses.

You can also typically use HSAs for health-related products and services, like:

Medications (prescription and over-the-counter)

Dental care

First aid materials

Orthopedic and therapeutic shoes

Sunscreen and select skincare products

Glasses and contact lenses

How can I contribute and what are the rules?

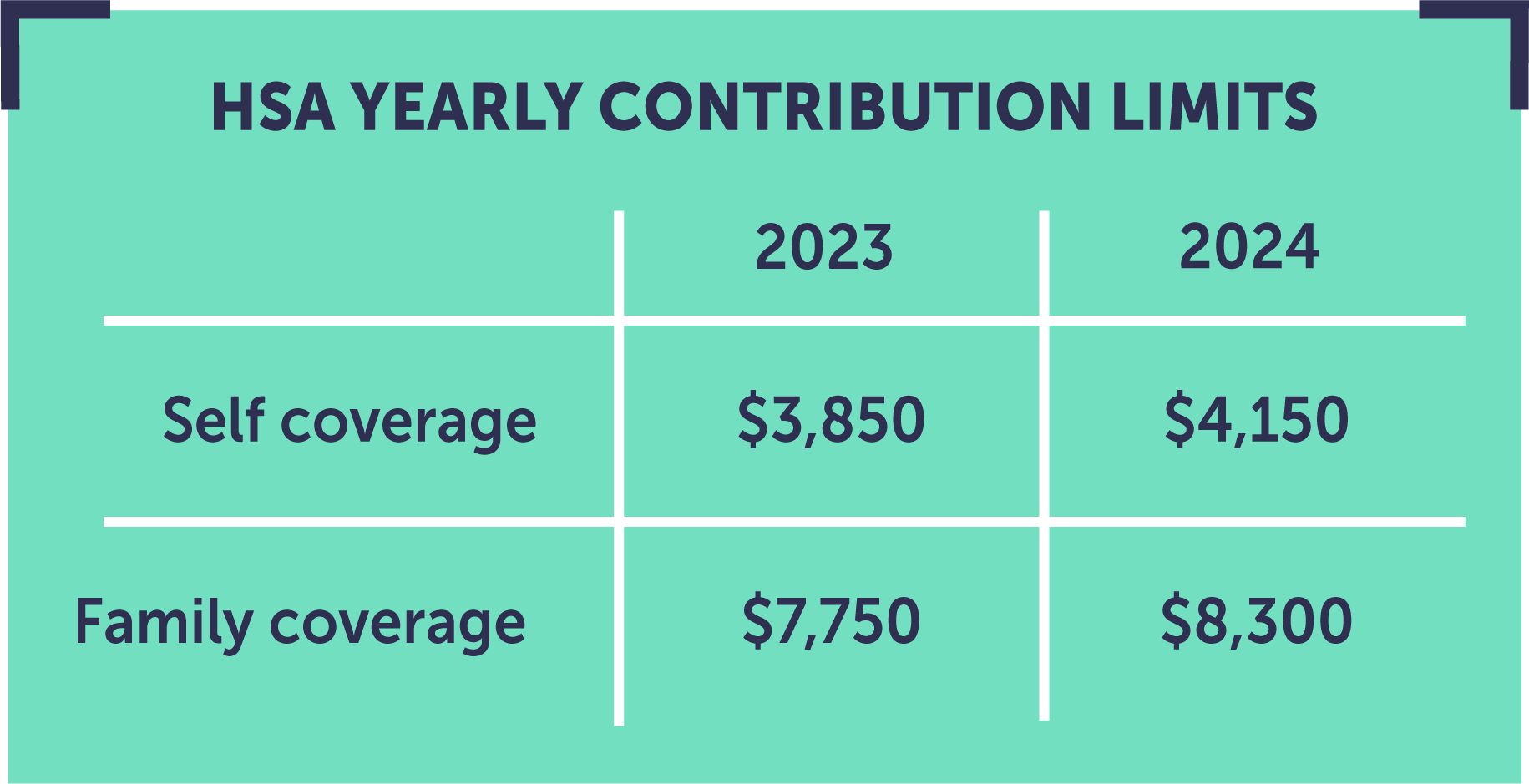

You can contribute to your HSA in a few ways, including payroll deductions, deposits, and transfers from other accounts. You don’t have to contribute the amount every month, and some employers may also contribute to employee HSAs. Remember that the more you contribute, the more tax benefits you can reap.

Those over 55 can contribute an extra $1,000 per year, which is called a catch-up contribution.

The IRS publishes updates on contribution limits every year, and you can also do a quick online search to find more information.

What are the benefits of an HSA?

An HSA works a little differently than an FSA, and while both types of accounts have the first two benefits in common, some additional perks are unique to an HSA.

1. Save money on medical expenses

The most obvious benefit of an HSA is probably its money-saving potential. Thanks to the tax-free benefits, your money can go further on qualified medical expenses. This is especially handy for the expenses you would have to pay for regardless, like prescriptions, copayments, and dental and vision care.

2. Lower your taxable income.

The funds for your HSA are taken out of your paycheck before taxes. That means whatever you contribute will be deducted from your paycheck, lowering your taxable income.

Plus, any interest earned on your HSA contributions can grow tax-free, and withdrawals are tax-free on eligible expenses. If you use the money for an ineligible expense, you’ll need to pay tax and may be subject to extra penalties.

3. Invest your money and watch it grow.

Typically, you can invest your HSA funds in stocks, bonds, and mutual funds once your account reaches a certain balance (usually $1,000). Your HSA investment account earnings can grow tax-free, and your HSA provider may have tools that suggest certain investments, or you can pick and choose for yourself. The number of investment options you have will vary depending on who you have your HSA with.

Investing involves risks, but it may help you maximize your money with little extra work. You might even have an Employee Assistance Program to help you better understand your investing options, like access to a financial advisor.

4. The money is yours to keep.

One of the great things about an HSA is that the money you put into it is yours to keep, even if you don’t use it in the same year you deposit it. If you keep saving, it'll even be around when you're ready to retire.

Plus, once you reach age 65, you may be able to use the money in your HSA for nonmedical expenses without any penalties — although you will probably have to pay income tax on withdrawals.

What is an FSA?

Like an HSA, a Flexible Spending Account (FSA) is an employee-sponsored account used to pay for healthcare costs. Unlike HSAs, you usually will only be able to carry funds so far into the future, and contribution limits tend to be lower.

Since the funds in the account are use-it-or-lose-it, your FSA may offer two options for carrying over a portion of your unused funds from one plan year to the next.

The first is a rollover limit that allows you to bring a certain dollar amount into the new plan year without counting toward your FSA contribution.

You might also have a grace period, which extends the last year’s funds up to 2.5 months into the next plan year — the exact length will depend on your plan, and not all FSAs have grace periods. After that, you’ll lose any remaining balance.

What types of FSAs are there?

In addition to a traditional health savings account, you might also have access to a few other types of FSAs:

Limited Purpose Flexible Spending Account (LPFSA): An LPFSA is a type of FSA that allows you to set aside pre-tax dollars for eligible medical expenses — in this case, only vision and dental expenses. It’s often offered in conjunction with an HSA.

Dependent Care Flexible Spending Account (DCFSA): DCFSAs work in the same way as an LPFSA but can only be used for eligible dependent care expenses, like daycare, preschool, after-school programs, and even some summer day camps. You can usually have this in conjunction with an HSA.

Commuter Flexible Spending Account (Commuter FSA): Getting to work costs money. Some employers offer Commuter FSAs, so you can use pre-tax dollars to cover transportation costs like public transit passes and parking fees.

What can an FSA be used for?

FSAs can be used for pretty much the same things that an HSA is used for — the main difference is that your FSA money usually expires after a certain amount of time.

In addition to deductibles and copayments, you can use your FSA for things like:

Medications (prescription and over-the-counter)

Dental care

Medical equipment

Orthopedic and therapeutic shoes

Personal protective equipment

Glasses and contact lenses

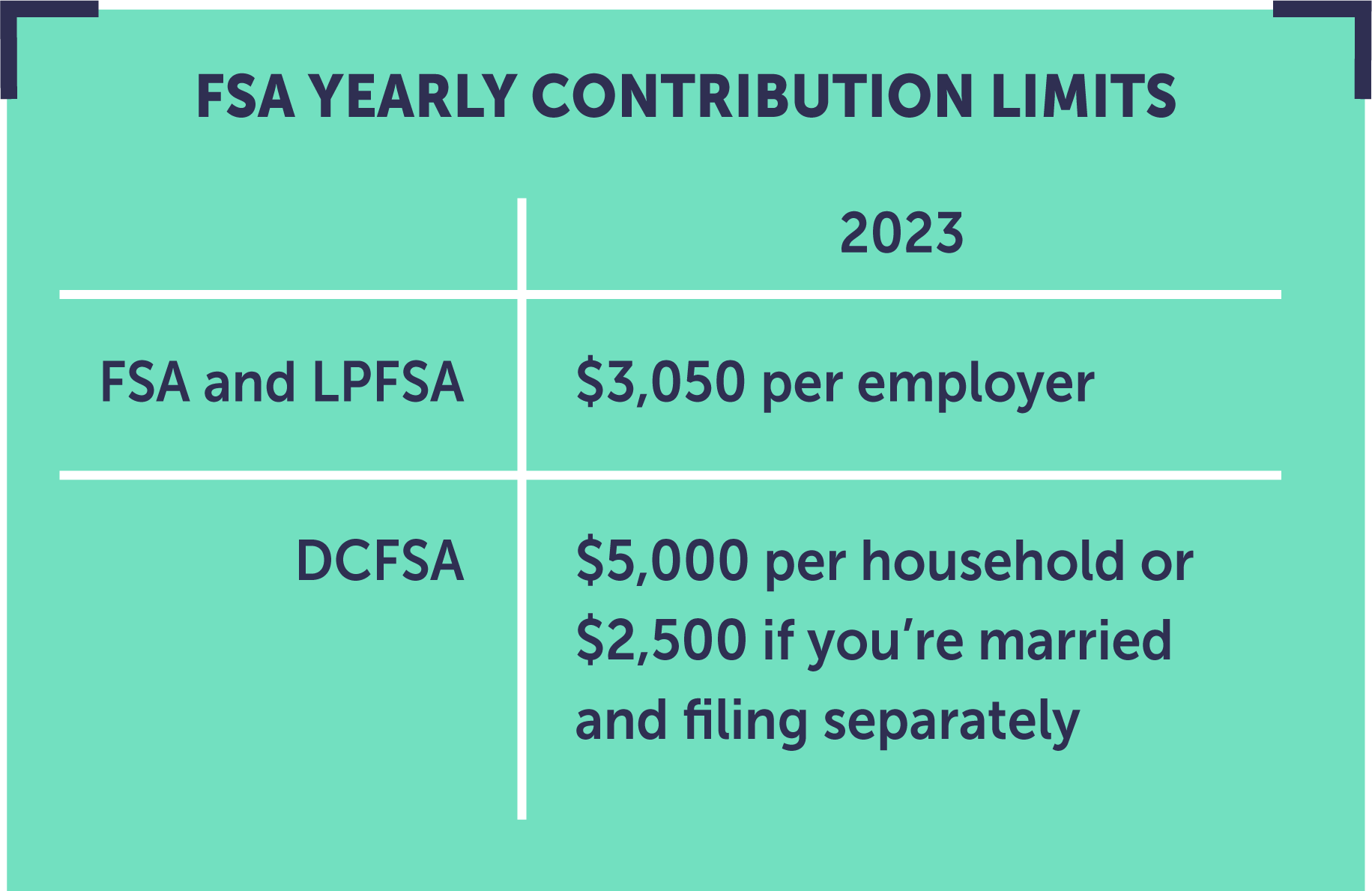

How can I contribute, and what are the rules?

If you have a spouse, they can also contribute $3,050 in an FSA with their employer. At a minimum, you’ll have to contribute $100 to your FSA.

Contributions are typically taken from your paycheck pre-tax, so you don’t need to worry about making any adjustments from month to month. If you need to adjust, you’ll likely have to wait for your next enrollment period or a Qualifying Life Event.

What are the benefits of an FSA?

Broken record incoming: for the most part, an FSA has the same basic benefits as an HSA. Keep in mind, though, that since the rules around using your money and investing it are slightly different with FSAs, you won’t get some of those perks.

1. Save money on your medical expenses.

Just like with an HSA, your FSA funds can be used for qualified medical expenses like the ones listed above. Since the money in your account is pre-tax, you’ll get more bang for your buck.

2. Reduce your taxable income.

Like an HSA, the funds in your FSA are taken out of your paycheck before taxes. That means whatever you contribute will be deducted from your paycheck, lowering your taxable income.

Any money spent from your FSA on qualified expenses will also be tax-free.

3. Get your money right away.

With an HSA, money is available as you contribute each month. With an FSA, you can choose how much you want to contribute for the whole year, and then the money is usually available right away.

Your contributions will still be deducted from your monthly paycheck, but you can use the full amount as soon as your plan kicks in, which is a pretty unique perk.

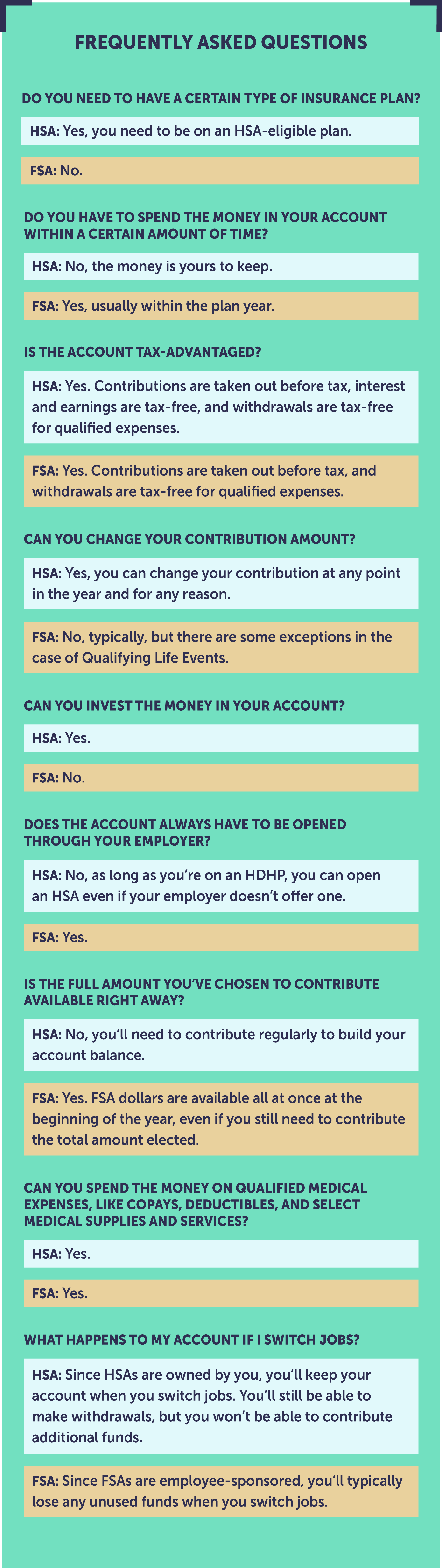

HSA vs. FSA FAQs

Still making sense of the differences between HSAs and FSAs? Here are some common FAQs to help you better understand what each account has to offer.

Once you demystify the jargon and acronyms of HSAs and FSAs, they’re a great resource for preserving your health and helping you save money.

Take this information with you next time you need to enroll — or if you already have one or more of these accounts! — and rest easy knowing you’re making informed benefits decisions.